In the modern economic climate, designated because of the inflation and ascending interest levels, the newest imagine homeownership was all the more evasive for some. New surge inside living will set you back and you can housing rates features posed tall challenges for these looking to go into the property idst this type of economic difficulties, are available land are noticed as an affordable option for potential people.

Such progressive are produced property are not only an easily affordable construction alternative though; it show an existence options, merging high quality construction, contemporary features, and financial attainability.

Those days are gone whenever manufactured residential property have been recognized as a keen lower otherwise temporary houses service. The new generation of are manufactured land is made having careful notice so you’re able to detail, making sure toughness one to opponents, and in some cases is preferable to, antique website-created belongings. These residential property are manufactured with the exact same materials because the old-fashioned residential property, into the additional benefit of are constructed in a managed environment, reducing weather-associated damage and you may delays.

Nonetheless they follow rigid design standards which might be implemented within each other state and federal accounts, which makes them the absolute most very carefully regulated and you may high quality-examined casing solution into the analysis of the Insurance Institute to own Team & Home Coverage (IBHS) figured whenever affixed formations try precisely strung, are made property showcase superior performance within the large-cinch requirements versus antique website-dependent house.

Are designed belongings give a quantity of adjustment that enables property owners to help you personalize the liveable space considering their requirements and you can choices. Out of individuals photos in order to personalized ends and you may centered-to-order enjoys, this type of land is actually hands-designed to satisfy personal requirements and you will choices. So it flexibility lets the individuals who happen to live around to produce good area that really feels as though their, without the large price have a tendency to regarding the personalized-based web site homes.

Possibly the very powerful element of manufactured home is their value. With costs for every sq ft are to forty five% less than equivalent webpages-centered homes, the dream of homeownership will get an achievable reality for some family members. They are:

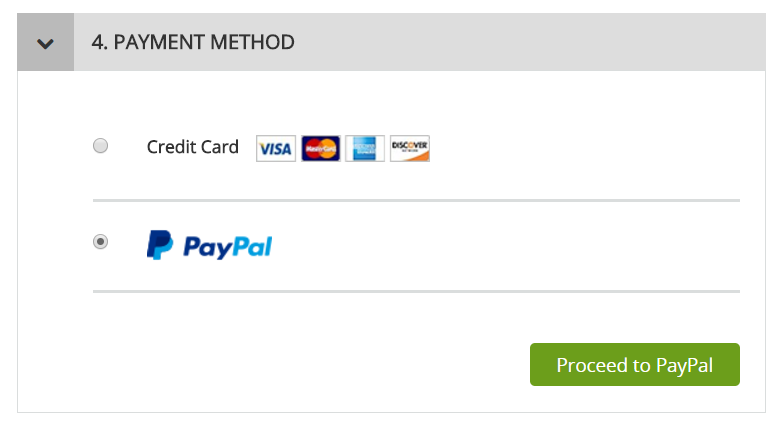

- FHA Loans: These types of bodies-supported loans have a tendency to bring advantageous fine print, which will make homeownership so much more possible. Although not, they are normally subject to rigorous standards in order to qualify, such a minimum credit score and you will money conditions.

- Conventional 31-12 months Financing: If the funded having property, some are made land can be qualified to receive antique mortgage solutions.

- Chattel Money: ADUs is bigger than 1,000 square feet and financed as an effective chattel mortgage. These types of fund can be used for are available land that don’t meet the requirements as the real estate. They are like automotive loans, that have reduced conditions and higher interest rates, but could become ideal for people trying to stop the price of home buy.

- Low down Costs: Alternatives exists to possess down money as low as 3.5% having a keen FHA financing, for example. This helps open the entranceway of these that have restricted coupons.

At initial Defense Bank, our company is purchased assisting you change your dream from affordable, high quality way of life toward a reality

One of the most well-known grounds people choose are designed residential property try the capability to live comfortably from the a fraction of the purchase price. But really additionally there is the benefit of forging the new relationships and you will a sense of area. To possess retirees who will https://elitecashadvance.com/payday-loans-wy/ be downsizing, getting into 55+ are formulated house communities permit them to make use of not just an inferior, manageable liveable space as well as the means to access business and you may particularly-inclined neighbors. These types of communities have a tendency to were clubhouses, swimming pools, and recreational activities, for example, that surely perception overall joy and you can well-getting.

An alternative choice is to utilize a manufactured house on your newest possessions. This can provide a functional solution for these seeking to downsize from the comfort of common surroundings. Through its quick impact, he or she is best for positioning to the present characteristics given that Accessory House Systems (ADUs). With the aging little one boomer age bracket, this gift ideas the possibility of remaining loved ones close by if not generating an additional source of income (based your own location’s ADU laws and regulations) as a rental.

The credit solutions for are produced house was varied and you may obtainable

Manufactured property portray a blend off cost, top quality, and you will customization. They are not only a short-term housing choice but good viable, fashionable choice for of many. That have an array of funding solutions, are built house features opened doorways for homeownership and you can authored versatile way of living choices having a diverse a number of some body. Whether you are seeking downsize, buy rental assets, or buy your earliest house, these types of modern residential property provides far to provide.

If you’re considering homeownership, do not ignore the benefits of are built property, and don’t forget that the correct resource can make a huge difference.