We are certainly Australia’s quickest expanding fintechs, building field top technical to alter the home loan industry as a result of our very own powerhouse assets labels and you can companies – Aussie and you can Lendi.

Lendi Class exists to transform the latest tiring, disjointed and sometimes daunting trip out-of funding a house on a good friction-free feel for all inside it.

Our get across-functional group away from very wise professionals and you can agents electricity all of our names, products, properties, relationships and you may networks to aid way more Australians safe their house hopes and dreams, effortlessly.

The names

Which have a discussed reputation for problematic this new updates quo, our very own labels bring various other skills getting customers but the endgame are always to assist a great deal more Australians go their property control goals.

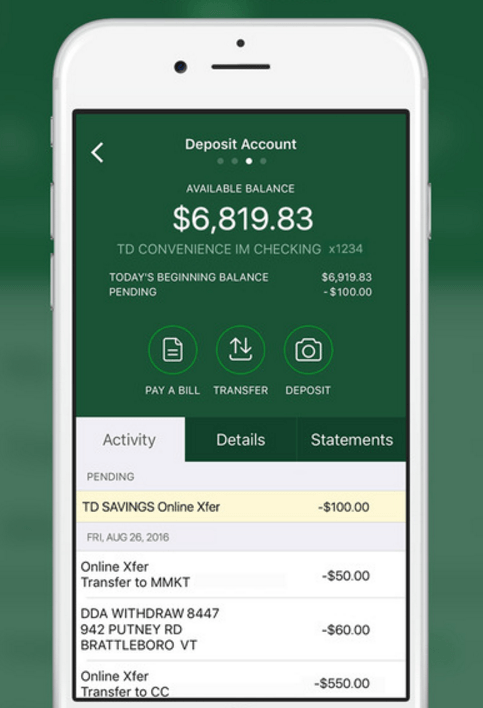

Lendi brings together sline the application procedure, and you will wise people giving endless professional advice, so americash loans Englewood smart users will get as much otherwise as little help because they you desire. With more than twenty-five lenders and most 2 hundred Financial Professionals, Lendi support Australians examine, and apply for the most compatible financial in order to satisfy the need.

Aussie is actually mainly based during the 1992 and you can try generally paid getting taking race toward Australian home loan broking globe. To own 30 years, Aussie Brokers have set home ownership close at hand out of even more Australians, providing more than one million people using their financial trip. With well over 230 stores across the country, Aussie contains the biggest merchandising brokerage impact across the Australia.

How come i are present?

Lendi Category hosts Australia’s first home loan program, a network more than step 1,300 agents, a head office team out-of 600 masters, a loan book over $80 mil and you may a retail impact greater than 230 areas nationwide – and you can we are for the an impressive progress trajectory.

Our house financing services try taken to business by the our renowned Aussie brand and all of our electronic disruptor Lendi brand.

The tale

Lendi Classification is actually molded of several labels who have been each other produced challengers, passionate by a want to find something complete in a different way for customers, agents and you will team members exactly the same.?

David Hyman with his fellow co-creators, Sebastian Watkins, and to encourage individuals with visibility and you will solutions while you are Aussie try built of the John Symond for the 1992 to carry race so you’re able to this new Australian home loan broking business.

Combining complementary habits, assets and you can possibilities, Lendi and Aussie merged in to produce the powerhouse Lendi Group and you may usher in a unique era regarding smooth commitment ranging from consumers, agents, loan providers, and research.

Today, Lendi Class try provided from the all of our President and Co-Founder David Hyman, along with our COO & Co-Creator, Sebastian Watkins.

What we should do

Within Lendi Category, we believe we are able to alter how people experience the realm of mortgage brokers and you can what we should perform is driven because of the our sight from smooth contacts.

By simply making seamless relationships ranging from consumers, agents, lenders, groups and analysis, we can simplify processes, empower individuals and you will totally free ourselves regarding program opportunities.

That means easier entry to addiitional information, smarter gadgets and higher options so our customers, brokers and you may couples spend less date towards administrator and much more day with the high value, large reward pursuits. It is win-profit.

I efforts a multi-brand approach, investing in the fresh new special Aussie and you can Lendi names in order to unlock increases in regards to our agents, partners plus the Class if you are providing a whole lot more options for Australian individuals inside their trip to secure their property ambitions.

How exactly we take action

Whether it’s closing the brand new pit between consumers and you will guidance, app and you may acceptance, agents and you will users if not between all of our inner organizations, closing new gap’ is how we are converting a formerly difficult and you can confusing processes in the an obsolete and you may disconnected industry. It’s how exactly we was modifying the way Australians sense domestic lending.

This involves existence due to all of our Aussie and you can Lendi names hence let Australians find the correct advice, consumer sense and you may home loan approaches to reach their home possession goals.