This new Government Property Management doesn’t always have even more restrictions towards their finance one to exceed the high quality restriction. Yet not, particular loan providers will get enforce their unique limits or terminology.

Jumbo fund are useful for high-net-value individuals purchasing high priced belongings. not, he’s much harder to help you be eligible for than simply a keen FHA otherwise fundamental conventional financing.

Including, you want 20% down getting an effective jumbo loan. Several lenders give jumbo fund at the 5-10% down, but not many.

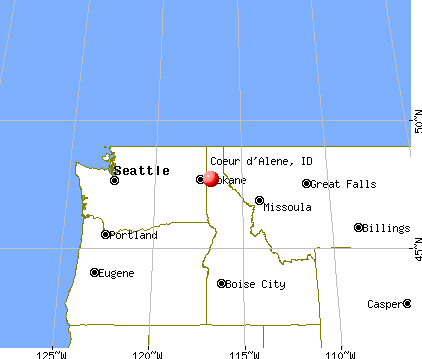

not, when you are to acquire a property when you look at the a premier-pricing city including Seattle, La, Denver, otherwise Boston, you may want to qualify for a giant FHA or antique loan, missing the additional conditions for jumbo finance.

FHA-recognized mortgages is actually prominent choices for very first-big date homebuyers and consumers with a high financial obligation otherwise a minimal credit score. Occasionally, FHA finance promote a route to homeownership getting candidates whom if you don’t may not be able to receive home financing.

But not, the fresh Government Homes Administration’s financial program has its limitations, specifically FHA financing restrictions. This short article talks about just how much currency you could borrow off a keen FHA financial by breaking down the present day FHA financing limits within the 2024.

Key Takeaways

FHA loan limits will vary by state and you will vary from $498,257 so you’re able to $step one,149,825 having one-house in continental You.

Limitation financing quantity disagree from the sorts of property. FHA multifamily financing restrictions are more than men and women to have single-family members property.

Irrespective of regional constraints, you nonetheless still need the money to help with the mortgage you’re implementing getting and should in addition to see simple FHA conditions.

FHA Financing Constraints by the Family Type and Venue

The most for an enthusiastic FHA mortgage may vary in accordance with the type of family you’re to purchase and its own place. Eg, FHA multifamily financing restrictions when you look at the Nyc is higher than the brand new limitation to own an individual-family home when you look at the Wichita, Kansas.

Maximum FHA financing to possess a single-home in most parts of the usa is $498,257 inside 2024. But not, located in a region appointed because the a high-rates city could make your entitled to highest constraints.

In certain portion, the fresh unmarried-product financing restriction climbs all the way to $step one,149,825, with many different groups all over the country that have limits anywhere between both of these numbers.

FHA mortgage restrictions throughout the unique exception to this rule aspects of Alaska, Their state, Guam, while the Us Virgin Isles was higher still considering the cost of structure on these locales. This new solitary-loved ones limitation in these portion is actually $1,724,725.

To own a far greater concept of the present day limits to possess FHA-backed mortgage loans, we have found a map evaluating limit financing wide variety because of the urban area together with quantity of residences toward possessions.

Just how can FHA Loan Restrictions Compare with Conventional Mortgage Limitations?

FHA loan limits tend to be below antique loan restrictions in the most common parts of the country. Once the feet FHA limitation to possess just one-house is $498,256, traditional financing constraints begin from the $766,550.

For the higher-cost portion, yet not, the FHA mortgage limitation is in connect having old-fashioned maximums. In these areas, your ount once the a conventional financing and both solitary-tool and you can multifamily mortgage constraints.

For example, the brand new FHA loan maximum to possess a one-equipment house in the San Antonio, Tx, try $557,750, if you find yourself traditional loan providers abide by their fundamental limit from $766,550.

How to discover your neighborhood FHA state loan restrictions is with HUD’s FHA financing limit product. Simply prefer your state and condition, make sure the unit is decided to help you FHA Forward therefore the newest 12 months, and then hit send.

Old-fashioned financing limits may also be put involving the simple and high-costs maximums in certain venues. For-instance, the 2024 one-tool old-fashioned loan restriction during the Steamboat Springs, Tx, is actually $1,012,000.