Jacob Wade has been a nationwide-accepted personal fund professional for the past years. He has got authored expertly towards the Equilibrium, LendingTree, CompareCards, Expenses Answers, or any other extensively-accompanied internet sites.

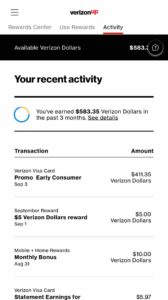

Collateralized Money

Collateralized funds are definitely the most well known and want placed cryptocurrency one is employed because the equity to your financing. Really platforms require more-collateralization, meaning that individuals have access to merely as much as a certain portion of the newest placed security (generally below a ninety% loan-to-value). The low the mortgage-to-worth (LTV), the reduced the pace, plus a lower life expectancy threat of getting margin titled.

Crypto Line of credit

Instead of giving a classic mortgage that have a predetermined title size, some networks provide a beneficial cryptocurrency line of credit. It is a kind of collateralized mortgage enabling profiles so you’re able to obtain doing a certain part of transferred guarantee, but there are not any place payment terms and conditions, and you will profiles are just energized notice towards the fund taken.

Uncollateralized Money

Uncollateralized financing are not as the well-known, nonetheless they form much like unsecured loans. Borrowers need to fill out a credit card applicatoin, admission identity verification, and you may over an effective creditworthiness review to be recognized. These financing possess increased threat of losses to own lenders due to the fact there isn’t any security so you’re able to liquidate in case there are good mortgage standard.

Flash Funds

Flash funds are typically available on crypto transfers and generally are immediate finance that are borrowed and you can paid down in the same purchase. Talking about very high-exposure funds that are typically used to make the most of business arbitrage opportunities, instance buying cryptocurrency getting a lesser price in a single field and instantly selling to have a higher rates an additional, all the into the same deal.

Risks of Crypto Financing

Cryptocurrency lending are inherently risky for consumers and you may loan providers since the newest funds and you can transferred loans was beholden into the elitecashadvance.com/loans/1-hour-direct-deposit-loans-in-minutes/ ever-unpredictable crypto market.

Margin Calls

When profiles vow collateral and you will borrow on they, a decline throughout the transferred collateral’s value can bring about good margin telephone call. This occurs if loan-to-worthy of (LTV) out of a crypto financing drops underneath the arranged-upon price. When this occurs, borrowers sometimes need put significantly more guarantee to find the LTV back off or risk liquidation.

Illiquidity

When crypto assets was transferred on to crypto credit platforms, they typically become illiquid and should not be utilized easily. Though some crypto financing systems allow loan providers so you’re able to withdraw placed funds rapidly, anybody else may require a long waiting period to access loans.

Unregulated

Crypto credit programs commonly managed and do not offer the exact same protections finance companies carry out. Particularly, You.S. lender dumps are Federal Deposit Insurance rates Organization (FDIC) covered for approximately $250,000 each depositor, plus the event the financial institution becomes insolvent, affiliate financing around one to maximum is safe. Getting crypto financing systems you to definitely feel solvency issues, there are no defenses to have pages, and fund are forgotten.

High Rates

Although some crypto loans give lower rates, really crypto finance fees more 5% Apr, with some charging as much as thirteen% Annual percentage rate (or higher).

Ways to get a good Crypto Mortgage

To try to get a crypto financing, profiles need certainly to sign up for a central lending platform otherwise hook an electronic purse to help you good decentralized lending system (such as for example Aave). Next, profiles discover the guarantee as transferred, and kind of loan and you will number desired to borrow. Extent readily available vary from the security and you can amount deposited.

Accomplish the transaction, profiles will have to put the collateral on platform’s electronic handbag, while the lent loans commonly quickly transfer to the new owner’s membership otherwise electronic bag.

How exactly to Lend Crypto

In order to become an excellent crypto bank, pages should create a financing platform, look for a backed cryptocurrency so you can deposit, and you will upload money toward program. On the a central crypto financing system, appeal could be paid in type otherwise with the indigenous system token. Into the a decentralized exchange, attention is given out inside the type, however, there’ll even be incentive repayments.

How does Crypto Lending Performs?

You notice a platform you to definitely lets you give or use crypto. The working platform otherwise borrower pays attention according to research by the terms you have put or even the platform spends.

Is Crypto Financing wise?

As you can earn passive income out-of crypto credit, it doesn’t always imply it is best. Decentralized financing apps are nevertheless probably one of the most used indicates theft bargain cryptocurrency.

Exactly how Successful Are Crypto Credit?

It depends about far your provide to a credit program, the latest terms you are provided, and whether field philosophy lose.

The conclusion

Crypto credit are a great decentralized financing service that enables cryptocurrency people so you can lend its crypto so you’re able to borrowers. It allows people to make attract to their cryptocurrencies since the industry opinions fluctuate.

Crypto financing shall be winning, but it also comes with the dangers of losings and you will thieves. Before making a decision in order to lend your own crypto, you need to thoroughly check out the systems to select the risks you might be adding yourself to as well as how profits functions.

The new statements, viewpoints, and you will analyses indicated on the Investopedia try to possess informative intentions on the web. Realize our assurance and you can responsibility disclaimer to find out more.