As big off money imply owing quicker on your financial of the beginning, boosting your downpayment amount is a good solution to create family equity right from the start. If in case it comes to antique mortgage loans, with a good 20% down-payment will help eliminate the requirement for individual home loan insurance policies (PMI), that will cost 0.1% 2% of the amount borrowed a year. Skyrocket Money SM can help you save for your house immediately based on your own paying models, and get towards the top of your finances to alter your bank account.

2. Build Huge Month-to-month Home loan repayments

The secret to strengthening security are making money into that dominating amount borrowed that which you actually are obligated to pay in your financial, perhaps not insurance or notice. Therefore, and then make large mortgage payments otherwise biweekly payments makes it possible to build equity quicker. When you yourself have a different sort of financing, eg a low-amortizing loan, you may need to generate more money to improve family security.

But to be able to create large or higher constant mortgage repayments is easier said than over. We recommend considering your financial allowance to possess elements your can cut right back toward or placed on hold into go out are. You might believe picking right up a side hustle whenever you are in a position to attract more earnings. It is possible to set-up a resources and even perform individualized expenses categories using Skyrocket Money.

step three. Renovate Or Upgrade Your house

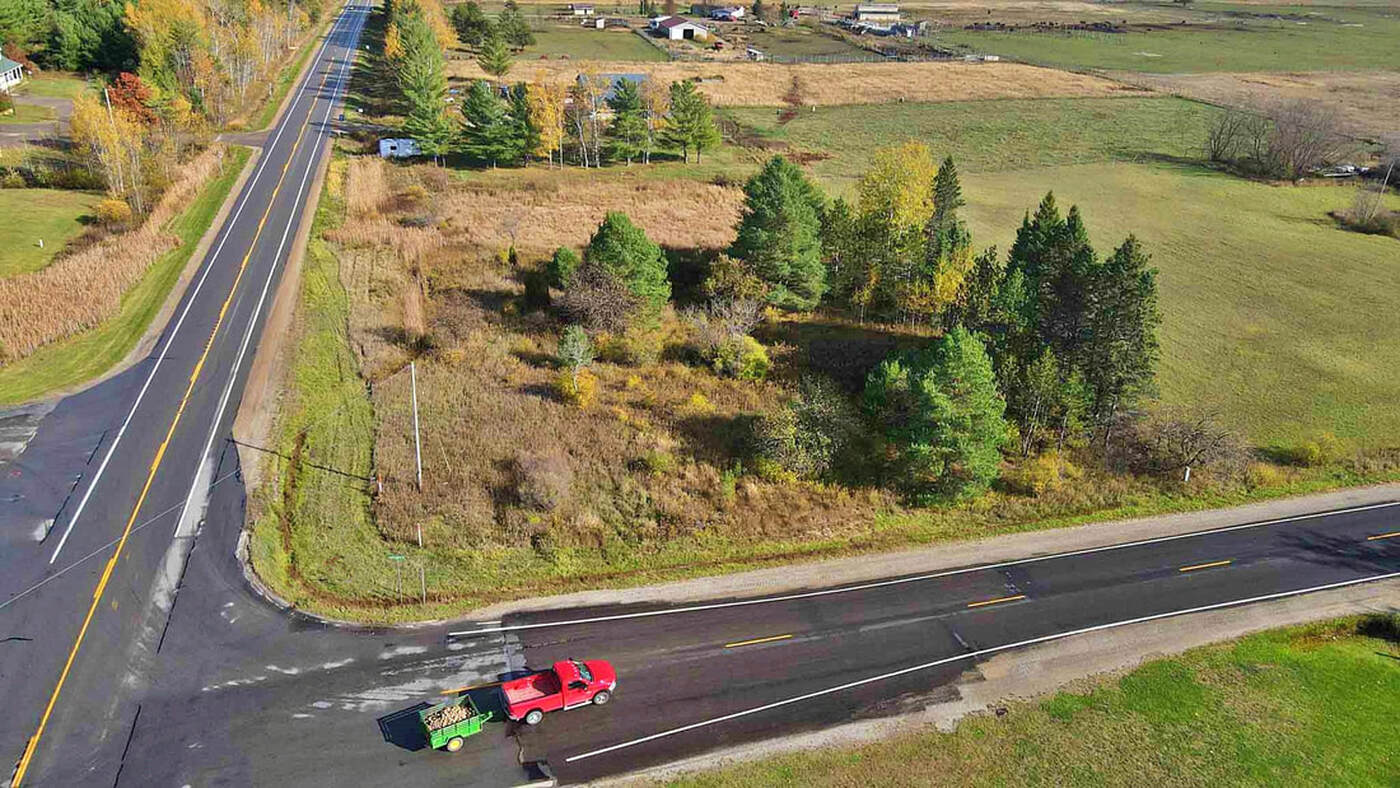

Such as we looked prior to, your house equity try truly related to your home worth. The simple truth is one in some cases you’re able to make equity purely according to sector criteria in case your area’s housing market try good, your residence well worth could go up with little to no alter for the home loan.

However, if you’d like to help the likelihood of increasing your residence’s worth, you might thought renovations or renovating your house. From inside the this, make sure to seek information or speak with a genuine house broker otherwise real estate agent that will help figure out which do-it-yourself systems do in reality raise domestic well worth and how you may go about them of your home.

Generally speaking, adding curb notice or kitchen and you can head bathroom remodels are good a method to offer your house’s value a boost. Less enhancements eg doorway otherwise window alternatives in addition to are apt to have a reputable return-on-investment (ROI).

The newest lengthened you stay-in your residence, the more date you must accumulate house guarantee. While this is nevertheless influenced by the amount of money you devote towards the mortgage prominent, remaining in one set much time-label go along with monetary professionals.

Very, as to why 5 years? The brand new homeowners are usually advised to remain set at the very least for the initial five years title loans in Colorado from having their property. This really is to stop taking a loss otherwise breaking actually in your domestic buy, that will happen once getting things like settlement costs and you can genuine home earnings under consideration. Due to just how mortgage loans work, it will take time to begin with spending a serious portion of the dominant, as most of very first years’ costs goes on the attention. This means its to your advantage to keep several decades, to spend your mortgage down while increasing your guarantee.

5. Refinance The Home loan

In some cases, refinancing a mortgage may also create equity. While you can easily however are obligated to pay an equivalent principal balance, refinancing can help you very own more of their house and you will quicker.

In the event that, by way of example, you refinance on the exact same home loan name but with a lower life expectancy interest, you need to use currency might or even end up being putting for the attention on your own home loan dominant alternatively. One other way refinancing will help is if you decide to reduce your loan label. Even although you try not to create extra repayments, you are paying their mortgage out of sooner than along with your early in the day mortgage.