In this article, we have been thinking about DSCR finance, which we think is one of the most readily useful choice to help you tough money funds.

What exactly is a hard money financing?

A difficult money mortgage was that loan safeguarded from the property. There are many good things on the subject. It personal easily – we’re talking four so you can 7 days, maybe even about three in some circumstances. Hardly any underwriting becomes necessary. The new disadvantages are they’ve higher interest rates, normally 12% or even more and so they need a good amount of equity in the household. Often,there are a painful money-lender that have a 20% off minimal, but the majority moments its to 40% otherwise 50%. Such fund are not perfect for long run dealers, but they’ve been ideal for people who move quickly.

- Short closings (you’ll in less than one week)

- Almost no underwriting

- Highest rates (typically several% or more)

- Highest costs

- Plenty of domestic equity required

- Bad for long term buyers

The brand new DSCR financing instead of hard currency

DSCR is short for Financial obligation Provider Exposure Ratio. An effective DSCR mortgage allows you to borrow funds on an investment property according to research by the appraised cashflow that it you will build, in place of your income.

Your debt solution publicity proportion try determined by taking the gross rent earnings and you will isolating they because of the dominant, notice, taxes, and you can insurance policies (PITI) fee. While the a formula that looks along these lines:

Very, what if their lease is actually $2500 along with your full PITI percentage are $3000. Their DSCR, within example, is computed as follows:

This gives you an effective DSCR proportion from 0.83, and as much time since your DSCR proportion try greater than 0.75, here in .

Positives out-of DSCR funds

Using this type of system, we’re generally enabling you to rating 100% borrowing for your lease. DSCR money keeps all the way down cost and you may charge than simply difficult currency, and you can down costs is really as low just like the 20%. It can be utilized to your requests and money-away refinances. However the excellent topic is that there is no rent needed. I make use of the industry lease about appraisal where i acquisition a cards sector studies in which a keen appraiser seems doing from the comp sales and you will apartments, therefore there isn’t any individual money requisite, you certainly do not need for your tax returns otherwise pay stubs, and then we don’t require evidence of your a career. Presents are permitted having down payments, and you can rating a loan all the way to $3.5 million. As well as, minimal credit rating is just 620.

- Lower Costs minimizing Charge than Difficult Currency

- Advance payment because the lower at the 20% down

- Pick and money-away Refinances acceptance

Downsides regarding DSCR financing

This is certainly style of the contrary from hard cash in brand new sense which you can’t spend this financing off having 6 months and is simply for capital services. It isn’t having 2nd house. As well as the household will need to stay static in a beneficial livable position. It can’t feel gutted, but it is primary should you decide into the leasing it, such as for instance.

That is the DSCR mortgage good for?

The fresh DSCR mortgage is perfect for traders who do not want to incorporate a job recommendations, tax statements, paystubs, W2s, etc; to possess buyers that happen to be looking to buy and you can flip features, for as long as rewards does not exist ahead of half a year off lona closing; and you can, people that thinking of buying and you will hold properties. It is a vintage for mind-functioning individuals that highly complicated earnings that looking to get a residential property, because solves the problem of getting to handle cutting-edge money revealing. It’s also higher when you yourself have a number of financial support attributes and you can say you maxed on the regular loan maximum out-of 10, the latest DSCR loan is a perfect option.

Be connected

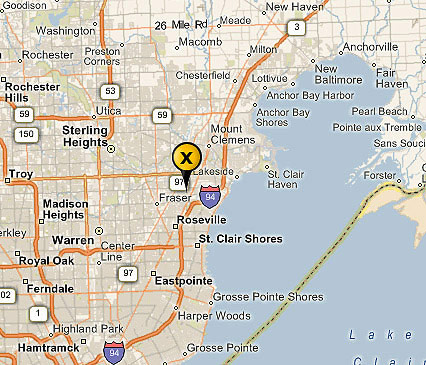

If you want to rating good DSCR mortgage, or you have any questions about something financial relevant, don’t hesitate to reach.

You could give us a call on 602-535-2171 or take us an email in the Make sure you inquire you having a totally free price in your next mortgage. We are going to be sure to give you custom services that assist you through the complete procedure.

Signature Lenders LLC will not give income tax legal otherwise bookkeeping pointers. So it matter could have been open to educational intentions only. You ought to check with your individual income tax court and you may bookkeeping advisers ahead of entering people deal trademark Home loans NMLS 1007154 And you may what is actually matter 210917 and you can 1618695 equivalent homes financial.