Skilled put

A gifted deposit are in initial deposit funded totally or in part because of the a money gift, constantly out-of a member of family otherwise friend.

Some loan providers (Aldermore, Furness, Area Bank and TSB) can give 100% mortgages having family relations-skilled deposits, and some offers all of them if perhaps an alternative group has contributed to this new put when it comes to a gift. This might be a provider provide, that’s a kind of security one arises whenever a seller also offers a purchaser a property in the a reduced price, sometimes to have an easy purchases.

Playing with equity regarding another type of property

If you have sufficient collateral an additional possessions you own, you may be in a position to discharge so it security to cover a beneficial put towards the a consequent purchase. For more info on the way it works, find out about remortgaging to invest in a moment assets .

Using a consumer loan

Funds commonly constantly named a valid means to fix improve a deposit, and the vast majority away from loan providers needs a darkened have a look at of this kind out-of approach. This will be partially by affect the financing get toward value, but mainly because they flags the latest debtor once the posing a high chance. This would of course suggest you are taking to the more obligations with the most readily useful of one’s mortgage

Having fun with playing cards

Playing cards are usually seen much like money, plus they you should never usually be employed to loans the whole put. However, as long as it will not payday loan Taylor Corners have a remarkable influence on the fresh amount you can afford to have a home loan, it can be you can easily (not protected) to use borrowing so you can top up a money deposit to assist the coupons increase subsequent.

Regulators techniques

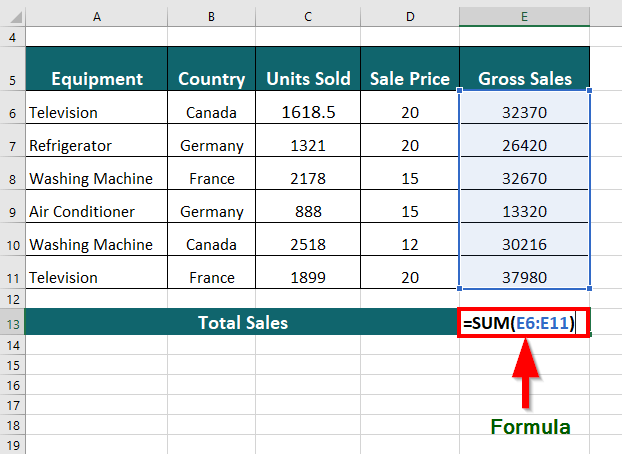

- 1. Mutual Ownership . This is where consumers own an excellent share’ of the home and you can spend quicker book into left ratio. Which contributes to a smaller sized home loan and this a reduced deposit. The fresh new table lower than suggests how taking right out a shared Possession financial you may reduce the deposit needed toward a house valued from the ?150,000, depending on how a lot of a percentage of the home your very own.

- 2. To Purchase scheme . In right situations, eligible social construction renters could pick the council household in the a beneficial discounted price otherwise no deposit. Certain lenders allow candidates to make use of their discount with the deposit, so it’s value talking to a professional representative that will learn which ones to method, specifically since the a number of lenders appear (All over the country, Barclays, Santander, Halifax).

- step three. Mortgage be sure plan . So it scheme lets home buyers buying which have an excellent 5% put, additionally the Government performs a shared chance to the home loan bank when there is people issues when your property should getting repossessed. A few loan providers (HSBC, Virgin Money, Natwest, and you may Barclays) will always be recognizing candidates until the strategy closes towards the .

- 4. Life ISAs was savings accounts for somebody aged 18-39, that they may use to improve money (in initial deposit) due to their very first domestic. For each and every seasons new membership was kept, the us government could add a twenty five% tax-totally free bonus, which will help you save getting a deposit more readily.

Preserving right up to possess a deposit yourself

This is the easiest alternative for those who haven’t ruled-out the possibility of protecting up-and don’t have to buy a household instantaneously. Extremely lenders will accept brief deposits regarding between 5% and ten% if you have a clean credit record and you can steady money, and if you are lucky which have time, a belong household costs you may mean their discounts can be worth significantly more after you come to buy.